Commerce And Accountancy Notes On – Bills Of Exchange – For W.B.C.S. Examination.

According to the Negotiable Instruments Act 1881, ‘a bill of exchange is defined as an instrument in writing containing an unconditional order, signed by the maker, directing a certain person to pay a certain sum of money only to, or to the order of a certain person or to the bearer of the instrument.Continue Reading Commerce And Accountancy Notes On – Bills Of Exchange – For W.B.C.S. Examination.

Features of Bill of Exchange

- It is important to have a bill of exchange in writing

- It must contain a confirm order to make a payment and not just the request

- The order should not have any condition

- The bill of exchange amount should be definite

- Fixed date for the amount to be paid

- The bill must be signed by both the drawee and the drawer

- The amount stated on the bill should be paid on-demand or on the expiry of a fixed time

- The amount is paid to the beneficiary of the bill, specific person, or against a definite order

Types of Bill of Exchange

- Documentary Bill- In this, the bill of exchange is supported by the relevant documents that confirm the genuineness of sale or transaction that took place between the seller and buyer.

- Demand Bill- This bill is payable when it demanded. The bill does not have a fixed date of payment, therefore, the bill has to be cleared whenever presented.

- Usance Bill- It is a time-bound bill which means the payment has to be made within the given time period and time.

- Inland Bill- An Inland bill is payable only in one country and not in any other foreign country. This bill is opposite to foreign bill.

- Clean Bill- This bill does not have any proof of a document, so the interest is comparatively higher than the other bills.

- Foreign Bill- A bill that can be paid outside India is termed as a foreign bill. Two examples of a foreign bill are an export bill and import bill.

- Accommodation Bill- A bill that is sponsored, drawn, accepted without any condition is known as an accommodation bill.

- Trade Bill- This kind of bill is specially related only to trade.

- Supply Bill- The bill that is withdrawn by the supplier or contractor from the government department is known as the supply bill.

Advantages of Bill of Exchange

- Legal Document- It is a legal document, and if the drawee fails to make the payment, it will be easier for the drawer to recover the amount legally.

- Discounting Facility- In cases where the drawer is in immediate need of money, the bill can be converted into cash by discounting it from a bank by paying some nominal charges.

- Endorsement Possible- This bill of exchange can be exchanged from one individual to another for the adjustment of the debt.

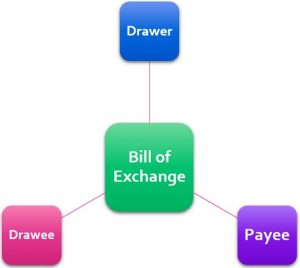

Parties of Bill of Exchange

A bill of exchange has three parties:

(1) Drawer:

- The drawer is the maker of a bill of exchange.

- The bill is signed by Drawer.

- A creditor who is entitled to receive payment from the debtor can draw a bill of exchange.

(2) Drawee:

- Drawee is the person upon whom the bill of exchange is drawn.

- Drawee is the debtor who has to pay the money to the drawer.

- He is also known as ‘Acceptor’.

(3) Payee:

- The payee is the person to whom payment has to be made.

- The payee may be the drawer himself or a third party.

Please subscribe here to get all future updates on this post/page/category/website

Toll Free 1800 572 9282

Toll Free 1800 572 9282  mailus@wbcsmadeeasy.in

mailus@wbcsmadeeasy.in