Management Notes – For W.B.C.S. Examination – Working Capital Management.

ম্যানেজমেন্ট নোট – WBCS পরীক্ষা – ওয়ার্কিং ক্যাপিটাল ম্যানেজমেন্ট।

What is Working Capital Management (WCM)

Working capital management refers to a company’s managerial accounting strategy designed to monitor and utilize the two components of working capital, current assets and current liabilities, to ensure the most financially efficient operation of the company. The primary purpose of working capital management is to make sure the company always maintains sufficient cash flow to meet its short-term operating costs and short-term debt obligations.Continue Reading Management Notes – For W.B.C.S. Examination – Working Capital Management.

BREAKING DOWN Working Capital Management (WCM)

Working capital management commonly involves monitoring cash flow, assets, and liabilities through the ratio analysis of key elements of operating expenses, including the working capital ratio, collection ratio, and the inventory turnover ratio. Efficient working capital management helps maintain the smooth operation of the operating cycle (the minimum amount of time required to convert net current assets and liabilities into cash) and can also help to improve the company’s earnings and profitability. Management of working capital includes inventory management and management of accounts receivables and accounts payables. The main objectives of working capital management include maintaining the working capital operating cycle and ensuring its ordered operation, minimizing the cost of capital spent on the working capital, and maximizing the return on current asset investments.

Elements of Working Capital Management

The working capital ratio, calculated as current assets divided by current liabilities, is considered a key indicator of a company’s fundamental financial health since it indicates the company’s ability to successfully meet all of its short-term financial obligations. Although numbers vary by industry, a working capital ratio below 1.0 is generally indicative of a company having trouble meeting its short-term obligations. Working capital ratios of 1.2 to 2.0 are considered desirable, but a ratio higher than 2.0 may indicate a company is not effectively using its assets to increase revenues.

The collection ratio, also known as the average collection period ratio, is a principal measure of how efficiently a company manages its accounts receivables. The collection ratio is calculated as the product of the number of days in an accounting period multiplied by the average amount of outstanding accounts receivables divided by the total amount of net credit sales during the accounting period. The collection ratio calculation provides the average number of days it takes a company to receive payment. The lower a company’s collection ratio, the more efficient its cash flow.

The final element of working capital management is inventory management. To operate with maximum efficiency and maintain a comfortably high level of working capital, a company must carefully balance sufficient inventory on hand to meet customers’ needs while avoiding unnecessary inventory that ties up working capital for a long period before it is converted into cash. Companies typically measure how efficiently that balance is maintained by monitoring the inventory turnover ratio. The inventory turnover ratio, calculated as revenues divided by inventory cost, reveals how rapidly a company’s inventory is being sold and replenished. A relatively low ratio compared to industry peers indicates inventory levels are excessively high, while a relatively high ratio indicates the efficiency of inventory ordering can be improved.

Compete Risk Free with $100,000 in Virtual Cash

Put your trading skills to the test with our FREE Stock Simulator. Compete with thousands of Investopedia traders and trade your way to the top! Submit trades in a virtual environment before you start risking your own money. Practice trading strategies so that when you’re ready to enter the real market, you’ve had the practice you need.

Please subscribe here to get all future updates on this post/page/category/website

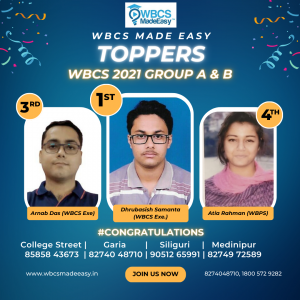

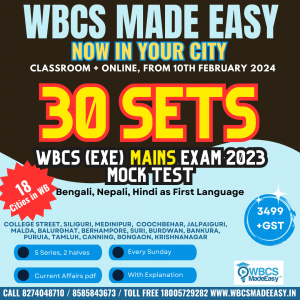

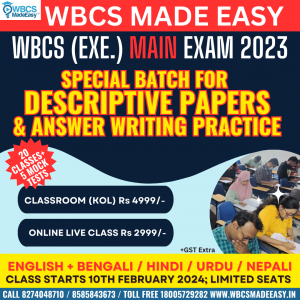

Toll Free 1800 572 9282

Toll Free 1800 572 9282  mailus@wbcsmadeeasy.in

mailus@wbcsmadeeasy.in